Form DIR-3 KYC

We can help you easily file Form DIR-3 KYC within 24 hours with just a few clicks of a mouse.

File Form DIR-3 KYC Now Consult Our Business Advisor Now

WHAT IS DIR-3 KYC FORM?

Recently, the Ministry of Corporate Affairs (MCA) had notified the introduction of the new form i.e. DIR-3 KYC where every director holding Director Identification Number [DIN] has to update their personal details on an annual basis.

OBJECTIVE

The main motive behind filing the DIR-3 KYC form is to conduct annual KYC of the Directors of all the companies and LLP. This will update the ministry of company affairs database of all directors holding DIN. Earlier introduced as a one-time form, The MCA has now made this e-form mandatory to be filed on 30th April every financial year.

WHO NEEDS TO FILE DIR-3 KYC FORM?

All the Directors and Partners of an LLP who have been allotted the Director Identification Number [DIN] require to file DIN-KYC on an annual basis. In order to reactivate DIN, such director shall have to pay a late fee of INR 5,000/-for DIN reactivation.

However, due to the outbreak of the Coronavirus pandemic, the directors who were deactivated due to the non-filing of the DIR-3KYC form can now fill this form without any late fee.

WHY FILE DIR-3 KYC FORM?

In the case of non-filing of DIR-3 KYC before due date, the director of the company will be disqualified and DIN status will be shown as ‘deactivated’ on the MCA portal.

On deactivation status, such a director cannot become a director in any new company and cannot file any ROC form on time which may cause a penalty on the company as well.

HOW TO FILE DIR-3 KYC FORM?

As per the MCA guidelines, DIR-3 KYC form is segmented into 2 categories:

- CATEGORY 1: Filing their DIN-KYC for the first time Or In case director have already filed the DIN-KYC but now wants to update DIN details.

- CATEGORY 2: DIN-KYC is already filed last year AND no update required in DIN details.

ANOTHER CHANCE FOR DEACTIVATED DIRECTORS TO FILE DIN-KYC

Due to the outbreak of the Coronavirus pandemic, the directors who were deactivated due to non-filing of the DIR-3KYC form are asked to fill this form once again. Their DIN status will then be re-activated on the MCA-21 Portal.

WHAT IS DIR-3 KYC DUE DATE 2019?

The due date of filing DIN-KYC is 30th April of every financial year.

PROCESS TO FILE DIR-3 KYC FORM

Upload the required documents & information to our web portal

Consult our business advisor regarding the director category of DIN-3 KYC.

Our professional will verify the validity of documents & Information provided.

On Confirmation, make an online payment with different payment modes available.

Our professional shall submit the application along with other relevant documents.

On successful verification, the DIR-3 KYC Form will be filed and SRN provided.

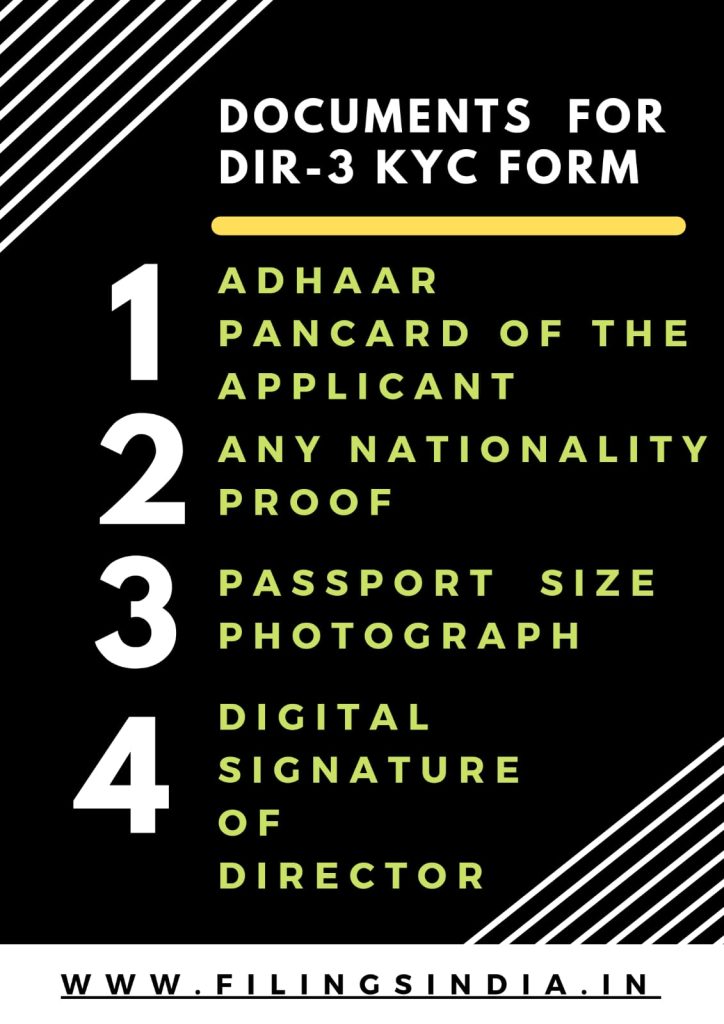

DOCUMENTS REQUIRED FOR DIR-3 KYC FORM

- PAN Or Aadhaar Card : The following Identity proof of the Director is required for DIN KYC: PAN Aadhaar

- Passport :The passport of the Director is required as his proof of nationality.

- Passport Size Photograph : One Passport size photograph of the Director.

- DSC : DSC or the Digital Signature of the director is required on the form DIR-3 KYC.