GST Registration

Concept:- Goods and Services Tax is a consolidated indirect tax policy that encompasses VAT, CST, Service Tax, Central Excise duty, Entertainment Tax, etc and is valid all over India with effect from 1st July 2017.

When to register for GST:- Mandatory to register under GST when annual turnover exceeds INR 40/20 lakh or supply goods and services inter-state or through E-commerce platform.

What are the GST tax rates:-Tax rates vary from 0% to 28% depends on the type of goods & nature of the services you are selling.

Input Tax Credit Availment:- Only business unit registered under GST can avail credit of tax paid at the time of purchase while filing GST returns.

Return Filing & Payment:-Every GST registrant requires to file three monthly/quarterly returns and One annual return. Requires paying tax every month.

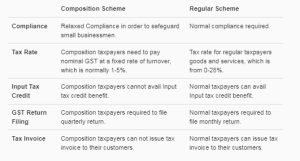

Composition Scheme:-Business Unit having an annual turnover less than INR 1.5 crore may opt the scheme. Requires to pay subsidize tax ranges from 1% to 5% & file quarterly return.

Turnover Criteria:- All taxpayers who have an annual turnover above ₹40 lakhs are required to get new GST registration.

Causal taxpayer:- If you supply goods or services in events/exhibitions where you do not have a permanent place of business, you need to get online GST Registration before starting a business. Such a dealer has to pay GST on the basis of an estimated turnover of 90 days. The validity of causal GST Registration is 90 days.

NRI taxpayer:- NRI taxpayer, who does not have a place of business in India, wishes to start a business, then he has to apply for GST Registration in India before beginning operations in India. The validity of a new GST registration is 90 days.

Agents of a supplier & Input service distributor:- All Input service distributor who wants carry-forward benefit of input tax credit requires gst registration.

Reverse Charge:- A business who requires to pay tax under the reverse charge mechanism need GST Registration.

E-Commerce portal:- Every e-commerce portal (such as Amazon or Flipkart) under which multiple vendor’s selling their product requires gst registration.

GST registration not only helps you in getting your business recognized as a legal registrant but also opens a number of opportunities for your business. Benefits to GST registered business at glance are as follows:-

Become more competitive:- You will be more competitive in comparison to your unregistered competitors since you will carry valid tax registration.

Expand your business Online:- You cannot sell products or services on E-commerce platform without GST registration. If you’re planning to give a blow on E-commerce platform like Flipkart, Amazon, Paytm, Shopify or through your own website, you must need a GSTIN.

Can take input tax credit:- Only Registered GST holders can avail input of GST tax paid on their purchases and save the cost.

Can sell all over India without any restrictions:- Without having GSTIN you cannot trade inter-state. This is possible only if you registered your business under GST.

Apply Government Tenders:- Various government tenders requires GSTIN to apply tender. If you don’t have, you may miss the business opportunity.

Open Current Bank Account:- Especially, in case of sole proprietor business Banks & Financial Institution does not open a current bank account in the name of business trade name unless you carry any government proof in the name of your business. GST registration certificate can help you to open a current bank account.

Dealing with MNCs:- Generally, MNC’s does not get comfortable to deal with small business entities until they carry valid tax registration proof.

GSTIN is an abbreviation for Goods and Service Tax Identification Number. It consists 15 alphanumeric digits. This is generated by the Government after you have successfully completed GST registration.

#First 2 digit show state code.

#Next 10 digit indicates PAN Number.

#Next 1 shows serial number of gst registration in a state.

#Last 2 digits are random.

GST Composition Scheme is for the small taxpayers, which is framed to reduce the tax compliance burden. Small taxpayers need not to file monthly GST returns and they need to pay nominal GST at a fixed rate of turnover. Any business having an annual turnover up to ₹1.5 Crore can opt for GST registration under composition scheme.

1

Provide the required business details and information to our web portal.

2

Choose a package and pay online with different payment modes available.

3

On placing an order, your application will be assigned to one of our dedicated professionals.

4

Our professional shall carefully examine the correctness & accuracy of the documents and file GST application form.

5

Our professional shall make regular follow up with Government department for processing of GST application online.

6

On obtaining GSTIN, we will provide GST certificate along with several eGuides on GST and GST Invoicing Software.

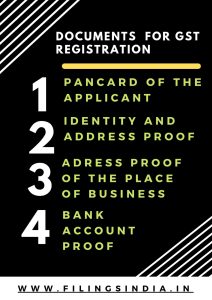

1. PAN Card of the Business or Applicant:- GSTIN is linked to the PAN of the business. Hence, PAN is required to obtain GST certificate.

2. Identity and Address Proof of Promoters:- documents like PAN, passport, driving license, aadhaar card or voters identity card must be submitted for all the promoters.

3. Address Proof for Place of Business:- Documents like rental agreement or sale deed along with copies of electricity bill or latest property tax receipt or municipal khata copy must be submitted for the address mentioned in the GST application.

4. Bank Account Proof:– Scanned copy of the first page of bank passbook showing a few transaction and address of the business must be submitted for the bank account mentioned in the registration application.

Documents for GST Registration

PAN Card- A PAN card of the indivisual is required

Identity & Address Proof -Adhaar card , Voter Id , Passport can be used as identity proof

Business Address Proof -Identity proof of business is required where you want open your business such as Electricity Bill / Rent Agreement

Bank Account Proof - Bank passbook front page photo is required